Natal-is / iStock via Getty Images

Investment thesis

crocs (NASDAQ: CROX) designs, manufactures and distributes casual footwear and accessories. I think CROX presents a great investment opportunity for a growth-oriented investor because:

1. They are rapidly increasing their market share worldwide resulting in accelerated revenue growth.

2. Their profitability is well above the industry average and cash flow from operations is increasing rapidly.

3. Their PER ratio remains below the median for the sector despite this growth and profitability.

Rapid expansion all over the world and accelerating revenue growth

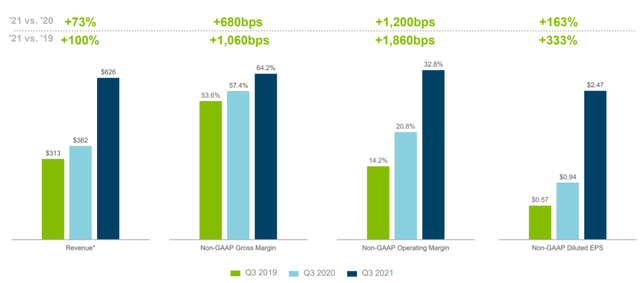

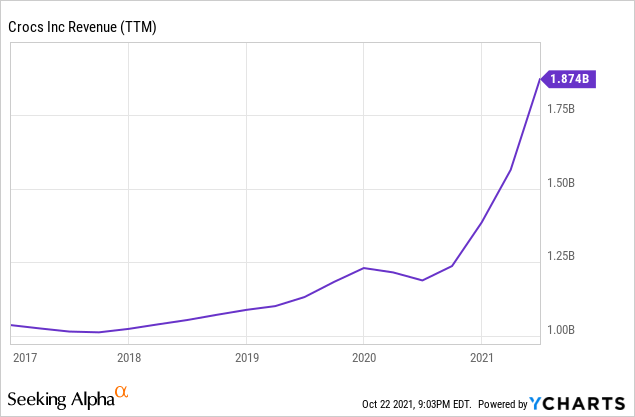

CROX is rapidly expanding its market share everywhere: Americas, Asia, Europe, etc. Based on the latest earnings call, their revenue grew 73% yoy and 100% in Q3 2019 (Americas 95% yoy, Asia-Pacific 24% yoy, EMEA 44%) . Their business groups come together at the perfect pace for their growth plan (new product development, marketing, celebrity endorsement, and digital sales). Recent cultural changes in the lifestyle and culture of the workplace, with remote working environments fueling a trend towards a more casual dress code, are contributing to the rapid growth of CROX. As the trends below show, there is a positive progression in revenue, margin and EPS growth trends, while the overall revenue trend shows a steep slope over the past 1-2 years.

Source: slide from presentation to investors

Exceptional profitability and growing cash flow

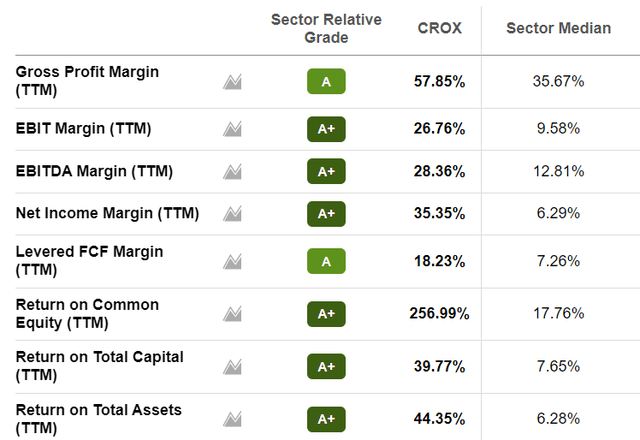

CROX’s profitability is exceptional. Each relevant profitability measure shows that their profitability is well above industry standards. Their EBIT margin (26.76%), EBITDA margin (28.36%), and profit margin (35.35%) are more than double the industry median. In addition, their gross margin and operating margin are improving. Along with this profitability, their operating cash flow is increasing nicely. Operating cash flow stood at $ 9.7M in 2015, but now stands at $ 469M (a 48-fold increase in 6 years!). This growth in operating cash flow is expected to continue at an incredible rate of 87.82% (Seeking Alpha estimate). The various profitability indicators are presented below.

Source: In Search of the Alpha

Undervalued by the market

Even with this exceptional growth and profitability, the market values CROX on par with its peers, based on their P / E ratio. CROX’s P / E TTM is 15.06 (sector median at 15.97) and CROX’s P / E FWD is 14.55 (sector median at 16.74). I think the market is pricing CROX badly at this point and hasn’t properly adjusted to CROX’s impressive growth rate. Even with a very conservative estimate (which will be presented in the next section), the market undervalues CROX by 20 to 50%. I expect the market to take notice of this pricing error and the CROX share price to adjust to a more appropriate level.

Estimation of intrinsic value

I used the DCF model to estimate the intrinsic value of CROX. For the estimate, I used EBITDA ($ 531M) as a cash flow indicator and the current WACC of 8.5% as the discount rate. For the base case scenario, I have assumed EBITDA growth of 20% (10% less than Seeking Alpha’s revenue growth estimate of 30%) for the next 5 years and zero growth by the continuation (zero terminal growth). For the bullish and very bullish case, I have assumed EBITDA growth of 25% and 30%, respectively, for the next 5 years and zero growth thereafter.

The estimate revealed that the current share price is up 20-50%. Even using a very conservative calculation (growth rate slower than Seeking Alpha’s estimate, assuming margins stay the same, etc.) this estimate shows that CROX is clearly undervalued by the market. Considering their rapid worldwide growth and digital sales, and improving margins, a 20-50% increase is well justified.

| Price target | Upside down | |

| Base case | $ 179.22 | 20% |

| Bullish case | $ 214.50 | 43% |

| Very bullish case | $ 255.58 | 71% |

The assumptions and data used to estimate the target price are summarized below:

- WACC: 8.5%

- EBIT growth rate: 20% (base case), 25% (bullish case), 30% (very bullish case)

- Current EBIT: $ 531 million

- Current share price: $ 149.76 (10/22/2021)

- Tax rate: 30%

Risk

The clothing industry is very cyclical in nature and sensitive to consumer trends. There are many alternatives available, and the customer has a very low changeover cost. Therefore, the technical moat is very shallow or even nonexistent. However, given the unique culture CROX is developing through its marketing campaign and celebrity endorsement, I believe CROX should be able to maintain its market share and continue to grow for the foreseeable future. I expect CROX to make its mark in the sports shoe market like Nike or Adidas in the sportswear market.

Continuing inflationary pressure and supply chain disruption can negatively impact CROX. Rising material and labor costs can squeeze margins, and supply chain disruption has the potential to significantly dampen growth. However, based on their latest earn calls and news from CNBC, CROX met these challenges exceptionally well. By relocating their manufacturing sites and using multiple transportation channels, they manage to stay ahead of the game. I think they will continue to do so. Also, I expect inflationary pressure and supply chain disruption to be transient (on the order of several years), relative to a long-term growth horizon for CROX.

Conclusion

I believe that CROX presents a great investment opportunity for a growth oriented investor. Their growth engine is running at full speed and they are expanding rapidly around the world. In addition, the increasing transition to more remote work environments and the widespread adoption of a casual dress code will also contribute to their growth trajectory. The pressure from inflation and supply chain disruption may present some risks, but it will be short-term and is not expected to impact CROX’s long-term growth path. I expect CROX to establish itself as a powerhouse in the casual shoe market, and I think the current share price is up 20-50%.